REDEFINE ON-CHAIN LIQUIDITYEXECUTION

Deluthium Protocol

The intelligent infrastructure powering institutional decentralized markets

ALL IN ONE ///

ALL IN ONE ///

ALL IN ONE ///

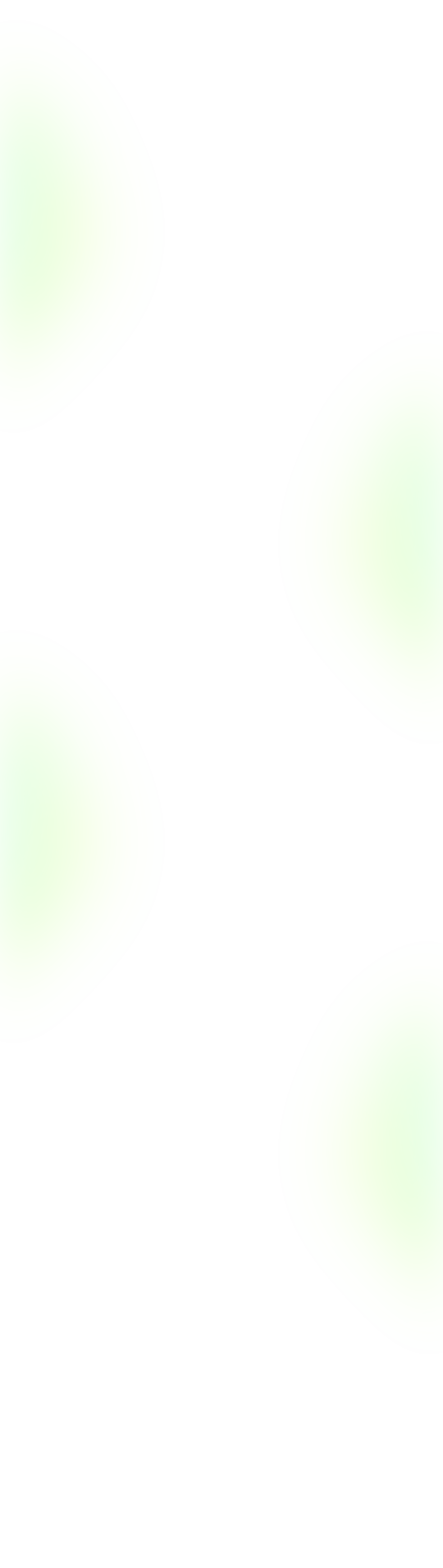

Deluthium PRO is the first institutional-grade, all-in-one DEX powered by the Deluthium Protocol, enabling synthetic TradFi exposure and TradFi-backed cross-collateral to seamlessly access spot and crypto perpetual markets.

Driven by Reinforcement Learning, the Deluthium Protocol is designed as an integrated execution and settlement system for decentralized markets operating under adversarial, discrete-time constraints. It introduces the first liquidity-driven competitive edge in DeFi, enabling scalable convergence of TradFi and crypto.

Optimal quotes with Near-Zero Friction

Delivers optimal, all-in quotes through an RL-driven, hybrid liquidity execution system. Liquidity is unified, sharded into adaptive execution streams, and dynamically routed to minimize friction and maximize price quality.

Maximized Efficiency with Full Verifiability

The advanced execution architecture enables institutional-grade capital and execution efficiency, while preserving DeFi-native properties of full verifiability and self-custody.

Privacy-Preserving Execution

Encrypted routing protects order intent and execution integrity. Trades are matched within a shielded environment prior to settlement, eliminating front-running and MEV, and ensuring the price you see is the price you get.

DELUTHIUM SYNTHESIS ENGINE

ADAPTIVE EXECUTION INTELLIGENCE

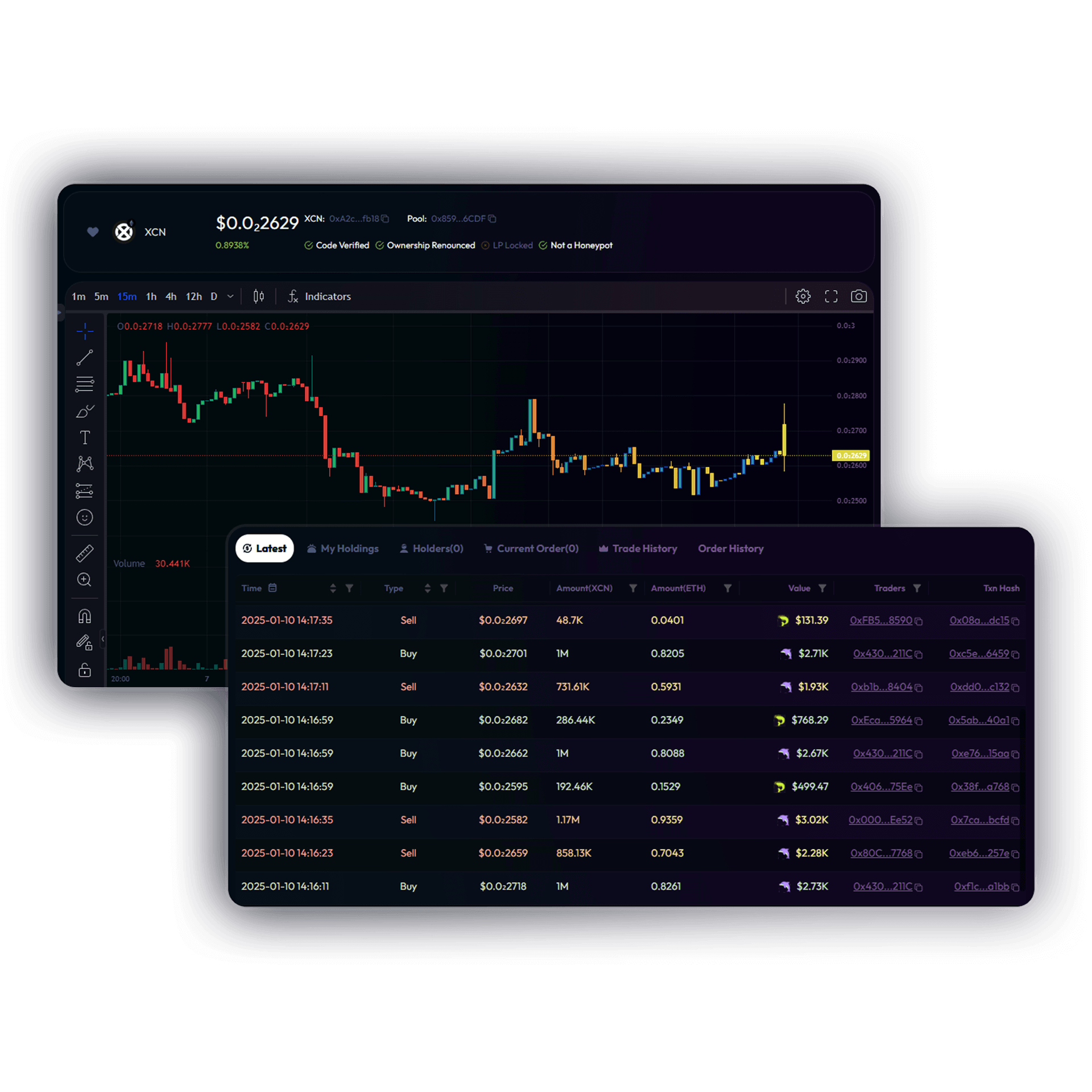

Deluthium transforms onchain execution with a Reinforcement Learning engine that functions as a Smart Order Sharder. It acts as the autonomous orchestrator behind every trade, dynamically sharding orders to prevent traffic jams on any single liquidity lane. Developers and institutions can now leverage a verifiable execution stack that optimizes for zero slippage.

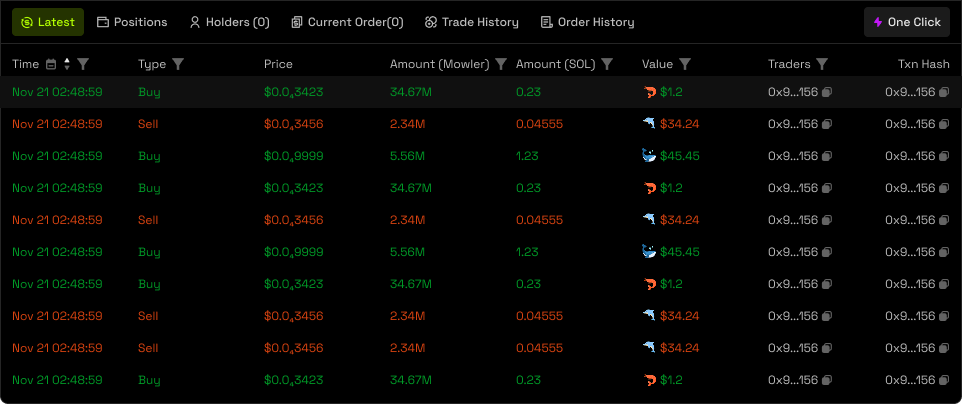

ATOMIC SETTLEMENT

CREDIT VAULT SETTLEMENT

Deluthium’s onchain Credit Vault enables atomic settlement, empowering Market Makers to maximize liquidity depth through enhanced capital leverage. Experience immediate finality and zero slippage relative to admitted quotes, bridging the gap between offchain speed and onchain security.

DUAL SHARDED LIQUIDITY MARKET

BILATERAL SHARDING MECHANISM

Deluthium democratizes institutional liquidity access via the Dual Sharded Liquidity Market. We shard both trading requests and aggregated liquidity into states optimally suited for matching. This structure enhances capital efficiency, allowing Market Makers to provide deep liquidity without capital friction. Deluthium evolves execution into a unified, intelligent fabric.

UNIVERSAL LIQUIDITY FABRIC

INFINITE SCALABILITY

Deluthium dissolves the boundaries between fractured liquidity islands. Our engine integrates liquidity into a unified and chain-agnostic Infinitely Scalable Fabric. This architecture supports all assets across markets allowing value to flow instantly and seamlessly, creating a singular ocean of liquidity where borders become irrelevant.

DELUTHIUM PROTOCOL

Welcome Back

Join us today and experience the power of AI text creation for yourself!

Send a message.

We're here to answer any question you may have.

Adding {{itemName}} to cart

Added {{itemName}} to cart